In the Russian Federation, cash transactions must be carried out using specially established forms of primary documentation. For such operations, unified forms have been developed and approved by the state. Based on a number of regulatory legal acts, they are made mandatory for use. The cash receipt order is no exception (the PKO form can be viewed).

Regulatory framework for PKO

Carrying out cash transactions by business entities to receive cash is accompanied by the execution of the primary document in question (here you can use a cash receipt order form in Word). The need to formalize cash transactions for accepting money by signing an order in form 0310001 is established in paragraphs 4.1 and 5 of Bank of Russia Directive No. 3210-U dated March 11, 2014. The unified form and content of this primary document are established by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88.

Receipt cash order (2017 form here)

The unified form of the cash order in question has been established and must be used for cases when cash is received at the enterprise's cash desk. This document (you can print the cash receipt order form here) must be written out in a single copy. It is signed by the chief accountant of the enterprise or another official who has the appropriate authority.

The unified form provides for the presence of a tear-off receipt for the PKO, on which, when performing a transaction, the signature of the chief accountant or another person with the appropriate authority is affixed. In addition, the cashier certifies the receipt with his signature and seal, after which it (the receipt) is handed over to the person from whom the cash was received at the cash desk (a cash receipt order and a sample of how to fill it out can be viewed here).

Having accepted the money, the cashier checks its quantity with the total value reflected in the primary document in question. If the values are equivalent, the cashier puts his signature, seal or stamp on the corresponding line of the order. If the value of the amount received at the cash desk turns out to be lower than in the PKO, the specified document is sent for re-registration to the accounting department.

The procedure for receiving cash from separate divisions to the cash desk of the parent organization is approved by the legal entity. The organization must also accept this money using an order in the established form (print out a cash receipt order form).

The unified form of this cash document contains, among other things, the following details:

- number and date;

- information for accounting (debit, credit, analytical accounting code, target purpose code);

- Full name of the person from whom the funds were received;

- the basis for acceptance with the attachment (if necessary) of the relevant document;

- the amount of funds accepted;

- signatures of the manager, chief accountant, issuing and receiving persons;

- a receipt for the order, given to the person from whom the cash was received, to confirm this fact (cash receipt order form).

Entrepreneurs who, on the basis of the Tax Code of the Russian Federation, take into account their income or income and expenses, other objects of taxation or physical indicators, have the right not to use cash documentation, including when accepting cash (a sample cash receipt order is here).

Cash flows at an enterprise can occur in two ways - non-cash and cash. Cash in the organization is stored, received, and issued through the company's cash desk. For the receipt of money, a cash receipt order (PKO or also abbreviated as “receipt note”) is drawn up. Sources of income may be revenue from buyers and customers, returns of accountable amounts, wages and other funds. To register the expenditure of funds in an organization, it is used.

In 2014, a directive from the Central Bank of the Russian Federation came into force, which established a new procedure for conducting cash transactions. With regard to the preparation of the PQR, it abolished the use of mandatory unified forms. However, most organizations still adhere to standard documents.

The receipt must be issued upon receipt of money. It can be filled out manually or using specialized accounting programs. The document is drawn up by the chief accountant, cashier, accountant, the manager himself (if he has taken over the accounting), as well as another person by virtue of a service agreement concluded with him. In the latter case, this specialist only writes out the document; only employees of the enterprise, for example, the director, must sign it.

As a rule, the accountant fills out a cash receipt order and passes it to the payer, who goes to the company's cash desk, where the cashier checks it, enters information into the registration journal, accepts the funds, cuts off the receipt and signs both halves of the document. Please remember that no changes may be made to this document. If an error is made, it must be reissued.

In accordance with the instructions defining the procedure for conducting cash transactions, individual entrepreneurs who maintain special tax accounting registers (for example, a book of income and expenses) are allowed not to draw up the corresponding PCOs when posting money to the cash register.

Receipt cash order sample filling

A receipt order includes two parts - an order and a receipt for it. The first part remains at the enterprise at the time the money is received, the second is given to the payer as confirmation of the deposit of funds.

Sample of filling out the main part

At the top of the form, indicate the name of the organization (full or abbreviated) in accordance with the registration documents, number, as well as the name of the structural unit. After this, the serial number of the recipient is entered, which must correspond to the number in the registration journal of the PKO and RKO, as well as the date. The tabular section contains the debit account (account 50 “Cash”), the corresponding account, and the amount. If necessary, you can fill in the columns “Structural unit code”, “Analytical accounting code”, “Purpose code”. The new instruction of the Central Bank of the Russian Federation allows for the absence of relevant sections in the receipt order.

IN line "Accepted from" information about the name of the payer is filled in. At the same time, if a legal entity deposits funds into the cash register, it is necessary to indicate here the name of the organization and through whom (full name) it transfers them.

Next, the content of this operation is filled in at the bottom. IN column "Amount" A record is made in words of the amount of money indicated in the tabular part of the document. The line “Including” filled out by organizations that are VAT payers. The amount of this tax is indicated separately here.

The application must indicate other documents that can be attached to the PKO (agreements, powers of attorney, receipts, registers, etc.).

The parishioner is endorsed by the chief accountant, indicating his position and personal details. After accepting the money, the cashier puts his signature and stamp “RECEIVED”

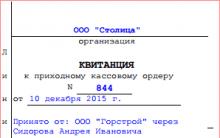

Receipt for cash receipt order sample filling

Information about the company name is also entered at the top of the document. After this, the details must be indicated PKO(number and date) to which it is compiled.

Next, the corresponding fields are filled in on the receipt by analogy with a cash receipt order. The date of receipt of funds must be indicated at the bottom, the chief accountant and cashier must sign with a description of their position and personal data. After this, the receipt must be stamped with the organization’s stamp and strain "RECEIVED".

Sample of filling out the PQS attached below.

Features of filling out some cash receipt orders

The cashier can draw up one receipt for the day's revenue on the cash register tape, strict reporting forms. In this case, the payer is the cashier (seller) of the organization, and the basis indicates the type of revenue (trade, for services, etc.), in the application it is necessary to record all the documents for which the order was drawn up. If this cash document is drawn up for the total amount accepted according to strict reporting forms (receipts), it is necessary to draw up a BSO register.

Organizations can make cash payments among themselves only within the established limit, so the cashier must always check the amount so that it does not exceed it. Otherwise, he, as an official and an organization, faces administrative liability.

The cash limit under an agreement between legal entities is currently 100,000 rubles. Those. this is the maximum amount of cash received during mutual settlements within the framework of one agreement; non-cash payments are not limited. It is not difficult to get around this limitation - when the limit is reached, you simply need to conclude another agreement with a different serial number and from a different date, and the PKO should indicate under which agreement the payment is made.

If the amount on the receipt order does not contain kopecks, then it is allowed to write it in the “Amount” column without kopecks.

The “Including” line may indicate not only VAT, but also other mandatory payments that must be highlighted separately when paying.

The company can receive money either non-cash or at the cash desk. To post cash in accordance with the Procedure for conducting cash transactions, you need to use a cash receipt order (PKO), for which the standard KO-1 form is provided. Only entrepreneurs who keep records in a simplified manner may not use it.

All cash transactions are currently regulated by the Procedure approved by the Central Bank of the Russian Federation. The receipt order reflects the receipt of cash at the cash desk. Its form can be unified or revised by the company taking into account existing features.

The form can be printed, filled in by hand, or designed using software.

The main requirement for it is that corrections cannot be made to the receipt. In this case, the document is reissued taking into account all the correct entries.

Depending on the job descriptions in the accounting department of the enterprise, this form can be drawn up by the cashier, director or chief accountant. It is allowed to issue Form KO-1 by a contracted specialist (in the absence of accountants and cashiers), however, in this case the signature must be affixed by the manager himself.

As a rule, the PKO is drawn up by an accountant and given to the person depositing money into the cash register. He presents this document to the cashier, who checks it and registers it in the appropriate journal. The specialist must also review all the documents that are attached to the PKO and check the order for the signatures of the chief accountant or manager.

Next, he accepts and counts the cash, and if the money matches the amount indicated in the receipt, the cashier puts his visa in confirmation. If necessary, a check is made for the received proceeds at the cash register, which is attached to the receipt.

The cashier hands over this detachable part of the PKO to the cash depositor as confirmation of acceptance.

At the end of the day, all receipt orders, along with the cashier’s report, are submitted to the accounting department.

Please pay attention! Upon returning from work, the employee must return the unspent money based on the receipt and report on the amounts spent within 3 working days upon return. In case of overspending, the company must reimburse these amounts at .

Receipt cash order sample filling

Main part

Let's look at a sample of filling out the PKO.

At the top of the form you need to write the name of the company and its code according to the OKPO classifier. If the order relates to a specific structural unit, then its name is written below in the corresponding column. Otherwise, a dash is placed here.

To the right of the name of the form, the document number in order and the date of its preparation are indicated. It is written in the form DD.MM.YYYY.

To the right of the name of the form, the document number in order and the date of its preparation are indicated. It is written in the form DD.MM.YYYY.

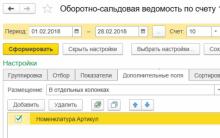

The following table contains accounting data - account codes for debit and credit, analytical accounting account code if used. In the “Amount” column, the funds accepted under this document are recorded in numbers. Column “Targeted financing code” filled out by those organizations that have developed and use the appropriate coding system.

IN "Accepted from" field write down from whom the money is accepted. If they are contributed by an individual, then his full name is indicated. in the genitive case. If the money comes on behalf of an organization, then its name is first written down, then the word “through” is put, and after it the full name. employee who makes the payment. For example, “Parus LLC through Petr Georgievich Ivanov.”

IN "Accepted from" field write down from whom the money is accepted. If they are contributed by an individual, then his full name is indicated. in the genitive case. If the money comes on behalf of an organization, then its name is first written down, then the word “through” is put, and after it the full name. employee who makes the payment. For example, “Parus LLC through Petr Georgievich Ivanov.”

IN field "Base" The reason for the receipt of funds at the cash desk is recorded - trading revenue, return of subaccounts, etc.

In the “Amount” field, enter the amount of funds received in words. If it contains any taxes or, for example, VAT, then in the “Including” column this amount is written down in numbers. Otherwise, the note “Excluding VAT” is made here.

IN Application field you must indicate the names of the documents that are attached to this PQR, or it is not filled out.

The document is certified by the chief accountant, who puts his signature and full name. and signed by the cashier who received the funds.

Receipt for cash receipt order sample filling

The receipt duplicates the data that was entered in the main part of the document.

The receipt duplicates the data that was entered in the main part of the document.

The company name is written at the top. Then in field “To cash receipt order” The number and date of the document are indicated.

IN "Accepted from" fields and “Base”, data from the corresponding fields of the main part of the document is transferred completely without abbreviations.

Below is the order amount in numbers and then in words. IN "Including" field the tax amount is recorded, or the “Excluding VAT tax” is marked.

The date of compilation is indicated below.

The receipt is certified by the chief accountant, who puts his personal signature, and signed by the cashier.

Nuances

Cash payments between organizations must be carried out within the established limit - 100 thousand rubles. The cashier is obliged to refuse to accept a larger amount, otherwise he and the organization face fines for failure to comply with cash discipline.

If revenue is received using a cash register or BSO, then at the end of the day it is allowed to issue one cash order for the entire amount of daily income. IN column "Base" in this case, indicate the number of the Z-report of the cash register or the numbers of issued BSO receipts.

Registration of a cash receipt order is an important element of cash discipline. It is filled out when cash arrives at the company's cash desk and always goes in conjunction with a receipt.

A cash receipt order can be issued in absolutely any situation: when money comes from the founder, when compensating for damage caused by employees of the enterprise, from the sale of company property, as payment for goods from the buyer, etc.

Since 2014, the execution of cash receipt orders, due to the simplification of the procedure for maintaining cash in organizations, has ceased to be mandatory; however, this document is still widely used there.

FILES

Rules for registering a cash receipt order

There is no unified sample of a cash receipt order, so each enterprise can develop its form at its own discretion or use a template. In recent years, it has become common for an enterprise to independently develop a PKO form, print it in a printing house, and accountants then fill it out manually. No less often there are situations when the form is filled out directly on the computer and then printed on a printer. Thus, an order can be drawn up either by hand or printed on a computer, but in any case, it must contain “live” signatures.

The document is signed by a specialist in the accounting department or an authorized employee, as well as by the cashier. It is not necessary to certify the form with a seal, since since 2016, legal entities, as previously and individual entrepreneurs, have the right not to use seals and stamps in their work.

The document is drawn up in a single copy and stored in the accounting department.

It should be noted that filling in pencil, just like blots, errors and corrections in the cash receipt order is unacceptable - this should be avoided, or, as a last resort, it is better to re-issue the document.

After filling out the cash receipt order, it is necessary to register it in the internal register of receipt and expenditure orders, and the receipt must be torn off along the dotted cut line and given to the person who deposited the money into the cash register.

Instructions for filling out a cash receipt order

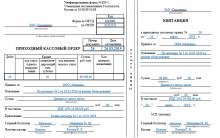

The standard cash receipt order form can be divided into two parts.

Part one

The first includes name of company indicating its organizational and legal status (IP, LLC, CJSC, OJSC), as well as structural subdivision, which writes it out (to be filled in if necessary, you can put a dash). Also here you need to indicate OKPO organization code(all-Russian classifier of enterprises and organizations) - you can find it in the constituent documents of the organization.

Next, just below, opposite the name of the document in the appropriate cell, you should write it number for internal document flow, namely, the register of receipts and consumables (the numbering of receipt orders must be continuous), as well as the date of its completion.

Part two

The second part of the cash receipt order is the main one and includes information directly related to financial receipts.

- In column "Debit" you should enter the number of the accounting account, the debit of which includes the received cash (most often the number 50 is put here, i.e. “Cash”). This cell is optional, so you can leave it blank.

- Next in the column "Credit" you need to enter the code of the department or division to which the finances are allocated (you can also put a dash) and the number of the corresponding account, which reflects the receipt to the cash desk. Also, if necessary, you need to fill out the column "analytical accounting code"(but if such codes are not used in the organization, the cell does not need to be filled in).

- Then to the column "Sum" The amount of money (in numbers) received at the cash desk is entered.

- To cell "Destination code" You must enter the destination code for the money received, but only if such codes are used in the organization.

- Below you need to indicate from whom exactly the money came (last name, first name, patronymic of the person), as well as the basis (here you need to enter the name of the business transaction, for example, “loan of funds”, “return of advance payment”, “payment under agreement”, etc. .)

- In line " Sum", again enter the amount of incoming funds, but in words. After making an entry, you must put a dash in the remaining empty field (to avoid falsification of the document). Here you need to highlight VAT, and if VAT is not used, then this should also be noted.

- In line "Application" details of attached primary documents (if any) are indicated.

In conclusion, under the document you need to put signatures of the chief accountant and cashier who accepted the money. The receipt is filled out in exactly the same way and then torn off along the cut line and handed over to the person who transferred the money.

Registration of incoming and outgoing cash orders is carried out according to certain rules. Let's look at the basic instructions.Nuances

Incoming and outgoing cash orders signed by the responsible employee immediately after the relevant transaction has been completed. The documents attached to them must be canceled with a stamp or the mark “Paid”. In this case, the date must be entered to avoid reuse of papers. According to the current rules, no corrections are allowed, even if they are agreed upon.

Form KO-1

You need to fill out the receipt order in one copy. The form consists of 2 sections. The first is a direct receipt order, and the second is a tear-off slip - a receipt. The latter is issued to the person who deposited the funds. The line "Base" indicates the content of the operation performed. For example, this could be “payment of invoice No. 321 dated February 1, 2017.” The "Including" field shows the VAT amount. The amount is indicated in numbers. If no tax is provided, then you should write “Without VAT”. The "Attachment" field lists the documents that accompany the order. The corresponding account is set depending on the source of funds. The department code is indicated by the operator of separate structural departments of the enterprise. The "Debit" cell should contain the cash account in accordance with the plan. The numbering of documents is continuous and is established for one year. The form should not contain numbers written out of order or duplicate codes. OKPO is considered a mandatory requirement. The information is indicated in accordance with the certificate issued by the state statistics body. The name of the organization is indicated in the same form in which it appears in the constituent documentation. If the company has approved analytics codes, they must be indicated in the order. There is a “purpose” cell on the document. It is completed only by non-profit enterprises with appropriate funding.

Features of certification

The receipt order is endorsed by the accounting department. If there are no specialists authorized to endorse the document, then this is done by the head of the enterprise. The director of the organization, by his order, may assign the responsibility for signing orders to another employee. In this case, the manager must agree on his candidacy with the chief accountant. If the director of an enterprise independently conducts financial transactions, then receipts, expenditure cash orders, cash book drawn up and signed by him.

Stamping

The imprint should be located on the part of the form marked “MP.” and grab the receipt. The legislation does not provide special rules for affixing a seal. In practice, it is customary to place 60% of it on the main part, and 40% on the receipt. Some recommendations are given in Resolution of the State Statistics Committee No. 88 of August 18, 1998. The legislation also does not establish a specific list of details that must be placed on the operator’s seal. It is advisable to include in the stamp information that was previously considered mandatory:

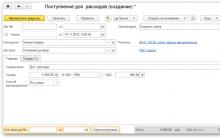

Document for issuing funds

The expenditure order is also issued in one copy. When issuing funds to an employee for reporting, the form should be drawn up in accordance with his written application. It can be in free form. The application must be signed by the head of the enterprise. It states:

- Amount to be issued.

- Term.

- Date of.

The "Base" field indicates the operation performed. For example, this could be “refund of overexpenditure according to report No. 123 dated March 2, 2017.” In the "Attachment" field, primary and other documents are indicated. At the same time, their numbers and dates of compilation are given. Applications can be applications for the issuance of funds, invoices, and so on. Rules for registration f. KO-2 are provided for in the Methodological Recommendations approved by Goskomstat Resolution No. 88. It is not allowed to make any corrections to the expenditure order. The document is also signed by the chief accountant, manager or other person authorized by him. Entrepreneurs who keep records of costs and income or physical indicators, according to tax legislation, may not issue expense vouchers.

Operator actions

When issuing funds for expense orders, the cashier must check:

- Availability of required signatures and their compliance with the samples.

- Equality of amounts indicated in words and numbers.

- Availability of documents provided in the form.

- Compliance with full name in the order information provided by the recipient.

After this, the operator prepares the required amount and hands over the payment document to the person receiving it. In the order, the recipient must indicate the number of rubles (in words) and kopecks (in numbers). The person also signs and dates it. The operator must count the prepared money. In this case, the recipient must see how the cashier does this. The subject who accepted the funds also recalculates them under the supervision of the operator. If this is not done, the recipient subsequently cannot make a claim to the cashier for the amount issued. After this, the operator must sign the payment document.

Important points

The cashier issues funds exclusively to the person whose information is indicated in the order. The latter presents a document confirming his identity. If the issuance is made by power of attorney, it is necessary to check the compliance of the full name. recipient, given in the order, information about the person represented. A document confirming the authority of the actual recipient is attached to the payment form. If several payments will be made under the power of attorney or in different organizations, a copy is attached to the order. The original must remain with the operator who made the last issue.

Accounting for incoming and outgoing cash orders

At the enterprises that draw up the documents discussed above, control over transactions with funds must be ensured. To do this it is necessary to conduct journal of cash receipts and disbursements. It records the details of payment forms before they are transferred to the operator. Orders issued on statements for the issuance of salaries and other similar amounts are entered into the book after the funds are provided to the recipients. The corresponding rule is enshrined in the Instructions approved by Resolution of the State Statistics Committee No. 88.

In practice, the question often arises: for what period is it necessary to open a journal for registering incoming and outgoing cash orders? It is worth noting that the legislation does not provide for any time limits. In this regard, issues relating to the period of use of the journal are decided by the accountant independently. You can open the book for a year, month, quarter. The number of operations should be taken into account when making an appropriate decision.

Responsibility for violating the rules

Measures provided for by law are applied to enterprises that do not comply with instructions for conducting cash transactions. Liability is established by various regulations. Among them is Presidential Decree No. 840 of July 25, 2003. Chapter 15 of the Code of Administrative Offenses provides for Article 15.1. It fixes penalties for violating the rules of working with cash and the procedure for carrying out cash transactions. In case of exceeding the amounts intended for settlements with counterparties, non-receipt (partial or full) of received funds, non-compliance with instructions for storing free money in excess of limits, an administrative fine is provided: 40-50 minimum wages - for officials, 400-500 minimum wages - for organizations.

Conclusion

Placing orders is a very responsible task. As stated above, corrections, errors and blots are not allowed in the documents. The operator responsible for drawing them up must remember that the order is a form of strict reporting. Therefore, documents should not be damaged. If any of the required details are missing, the completed order will be considered invalid.

Tell your wish at home

Training “Creative Typography”

Fortune telling about pregnancy and the gender of the child

How to make a wish for the New Year so that it comes true

Strawberry jam, jam, marmalade