In the 1C 8.3 Accounting program, generate the receipt and acceptance of fixed assets for accounting.

Fixed assets are inventory assets worth more than a certain amount (constantly increasing) and whose useful life is more than a year.

Fixed assets include buildings, structures and other real estate, construction projects, equipment, power lines, pipelines and so on.

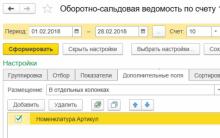

In the 1C 8.3 system, fixed asset accounting has several separate sections that contain all the necessary operations for full-fledged work on this topic:

- Section “Receipt of fixed assets”. In this section, documents on the receipt of equipment and additional items are created. expenses in 1C 8.3, which are included in the cost of fixed assets. Also in this section 1C the acceptance of OS for accounting is formalized.

- In the “Fixed Asset Accounting” section, you can create documents reflecting the movement, modernization and inventory of fixed assets.

- The section “Retirement of fixed assets” contains documents on the write-off and transfer of fixed assets.

- The section “Depreciation of fixed assets” is responsible for depreciation calculations and accruals.

In this article, using a step-by-step example as a step-by-step instruction, we will look at the main operations related to accounting for fixed assets in 1C 8.3.

How to capitalize a fixed asset

Receipt can be in the organization (purchase of fixed assets) and in leasing. In this article, we will consider accounting for acquired fixed assets.

So, let's create a document for capitalization of the OS. Example of a completed document:

Receipt of additional expenses for the operating system

The initial cost of equipment and other fixed assets is formed at the acquisition stage not only from the purchase price, but also from installation costs and other expenses associated with the acquisition.

Therefore, it is worth considering two documents:

- Receipt of additional expenses

- Transfer of equipment for installation

You can create them in the section “Fixed assets and intangible assets” - Receipt of fixed assets. As usual, documents are created by clicking the "Create" button. In the header of the document, fill in the standard details - Organization and Counterparty.

In the tabular section, in the “Main” tab, the amount of additional costs is indicated:

On the “Products” tab, the fixed asset item is indicated, the cost of which includes these expenses:

Transfer to installation

In this document we will fill in the following details:

- Organization

- Stock

- Construction object

- Cost item

Let's add equipment to the table section:

The above documents must be created before the fixed asset is accepted for accounting.

How to register and put into operation an OS

We will show how the document is filled out; as a result of posting the document, the equipment moves from account 08.04 to account 01.01.

Non-current asset tab:

OS tab:

Depreciation in transactions will be charged to account 02.01:

Moving the OS to 1C

The movement of a fixed asset is very similar to the movement of goods, only the goods are moved between warehouses, and the fixed asset between departments (after all, we have already taken it into account).

When preparing a document, only the details “Accrual of depreciation” and “Method of recording depreciation expenses” may raise questions.

These details should be indicated if depreciation needs to be calculated after the move. We will leave them empty and charge depreciation at the end of the month:

Inventory of fixed assets

Inventory of fixed assets in 1C is practically no different from inventory of goods, only, again, instead of a warehouse we indicate a division (more information about goods in the article Inventory in 1C 8.3). In the tabular section, instead of quantity, we indicate the presence of a fixed asset:

If a fixed asset is not listed in accounting, but in fact it is, a document of acceptance for accounting is made based on the inventory, and vice versa, if it is actually missing, we write off.

Write-off of fixed assets

Here, in addition to the standard fields, we indicate the reason why the fixed asset is written off:

We will not post the document, since we will still need the fixed asset to consider the depreciation operation.

Depreciation of fixed assets

Calculation and recording of fixed assets depreciation is done using the month-end closing assistant. The operation is performed once a month and, as a rule, at the end:

To open the assistant, you need to go to the “Operations” menu, then follow the link “Closing the month“. The assistant window will open immediately. In it you need to select a period and organization. Then the assistant will do everything himself. All calculations in the assistant are made sequentially, and depreciation deductions are calculated first. If the operation went through without errors, a document for the routine operation “Depreciation and depreciation of fixed assets” will be created:

Let's see what depreciation postings 1C generated for us:

As you can see, the amount of depreciation on our machine was 731.45 rubles. Let's check the correctness of the calculation.

The machine was registered for 61 months. The original cost was 44,618.64 rubles (excluding VAT, depreciation is not charged on the amount of VAT). Depreciation is calculated using a linear method, so to check, simply divide 44618.64 by 61. The result will be 731.45 rubles. The calculation is correct.

Based on materials from: programmist1s.ru

Fixed assets are equipment, vehicles, buildings, machines, computers - all the property that is used by companies to produce products or provide services. Another important feature of a fixed asset is its useful life; it must be more than 12 months. There is also a cost criterion; it is different for accounting and tax accounting. Acceptance of OS for accounting in 1C 8.2 is carried out in several stages. Read step-by-step instructions on how to register an operating system in 1C 8.2.

Read in the article:

In 1C 8.2, the acceptance of fixed assets for accounting consists of two stages:

- purchase of fixed assets. At this stage, the receipt of property is reflected in the debit of account 08 “Investments in non-current assets”;

- acceptance of fixed assets for accounting. Equipment ready for use is reflected in accounting as the debit of account 01 “Fixed Assets”.

Below, read the instructions on how to register an operating system in 1C 8.2 in 9 steps.

Purchase of fixed assets in 1C 8.2

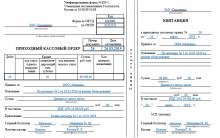

Step 1. Create an invoice for the receipt of fixed assets in 1C 8.2

Go to the “Purchase” section (1) and select the “Receipt of goods and services” link (2). A window will open to create an invoice for receipt.

To create an invoice, click the “Add” button (3) and select the “Equipment” link (4). An invoice form will open for you to fill out.

Step 2. Fill in the details in 1C 8.2 in the invoice for the receipt of fixed assets

In the form that opens, enter the following information:

- date of receipt of the fixed asset (5);

- your organization (6);

- supplier of fixed assets (7);

- details of the contract with the supplier (8);

- to which warehouse the property was received (9).

Step 3. Fill in the “Equipment” tab in the invoice

In the “Equipment” tab (10), click button 11, then button 12. The nomenclature directory will open - a list of your organization’s property.

In the item reference book, click the “Add” button (13). A window will open to create a new item. Enter information about the fixed asset into it.

In the window that opens, indicate the short (14) and full (15) name of the fixed asset. In the “Unit of measurement” field (16), select the value “Pieces”. To save, click “OK” (17). Data on the fixed asset is recorded in the program.

Select new equipment (18) from the list and click on it so that it is included in the invoice being created.

Now the invoice 1C 8.2 reflects the purchased property (19). Next, fill in the information from the supplier’s invoice. Please indicate:

- number of equipment (20);

- price (21);

- VAT rate (22).

Step 4. Fill in the “Additional” tab in the invoice for the receipt of property

In the “Additional” tab (23), indicate the number of the invoice from the supplier (24) and its date (25). Click the "OK" button (26). Expenses for the purchase of fixed assets are fixed in the program.

The first stage is completed, now the purchased equipment is reflected in the accounting records as a debit to account 08 “Investments in non-current assets”.

Acceptance of fixed assets for accounting in 1C 8.2

At the first stage, we formed the value of the fixed asset by debiting account 08 “Investments in non-current assets”. Now we need to capitalize it and transfer the value of this property to the debit of account 01 “Fixed Assets”.

Step 1. Open the “Acceptance for accounting of fixed assets” form in 1C 8.2

Step 2. Fill in the basic data in 1C 8.2 in the form “Acceptance for accounting of fixed assets”

In the form that opens, indicate:

- date of acceptance for accounting (3);

- your organization (4);

- the division to which the fixed asset belongs (5);

- warehouse where the fixed asset is located (6);

- equipment (7). In this directory, select the equipment that was indicated in the delivery note;

- select from the directory “Acceptance for accounting” (8).

Step 3. Fill in the data on the fixed asset in 1C 8.2

In the “Fixed Assets” tab (9), click the “+” button (10), and click on “…” (11). The fixed assets directory will open.

In the window that opens, click the “Add” button (12). A card for creating a new fixed asset will open.

In this card:

- fill in the name of the fixed asset (13);

- select OS group (14) from the directory;

- indicate the full name of the fixed asset (15);

- select from the directory the OKOF code related to your fixed asset (16);

- select the OS accounting group (17) from the directory;

- in the “Asset Type” field, select the value “Fixed Asset Object” (18);

- select the depreciation group of your fixed asset from the directory (19);

- select the code for ENAOF (20) from the directory.

Click the "OK" button (21). Now a new fixed asset has been created in the fixed assets directory.

Attention!

It is important to know that depreciation can be calculated regardless of whether you actually use the fixed asset or not. Even if the fixed assets remain in the warehouse, depreciation can be calculated on it. It is not accrued provided that the OS is placed into conservation. Moreover, the period of such preservation is more than 3 months.

Select this fixed asset in the “Fixed asset” field (21) of the “Acceptance for accounting of fixed assets” form.

Step 4. Fill out the “Accounting” tab in 1C 8.2

In the “Accounting” tab (1), fill in:

- Accounting procedure (2). Select “Depreciation calculation”;

- MOL (3). Specify the financially responsible person;

- Method of admission (4). Select “Purchase for a fee”;

- Check the “Accrue depreciation” box (5);

- Method of calculating depreciation (6). Select the method you need from the directory, for example “Linear”;

- Method of reflecting depreciation expenses (7). Select the method that indicates the depreciation account suitable for your fixed asset (20,23,25,26,44);

- Useful life (8). Enter the useful life in months for your fixed asset.

Step 5. Fill out the “Tax Accounting” tab in 1C 8.2

In the “Tax Accounting” tab (1), fill in:

- procedure for including costs in expenses (2). Select “Depreciation calculation”;

- check the “Accrue depreciation” box (3);

- useful life in months (4).

All data in the “Acceptance for accounting of fixed assets” form has been completed. Click “OK” (5) to generate accounting entries. Acceptance of OS for accounting in 1C 8.2 has been completed.

In accounting and tax accounting, you can set different depreciation methods. But this is a very labor-intensive option. As a result, you will have significant differences between accounting and tax data that need to be adjusted. Therefore, the simplest option is to charge depreciation equally.

Fixed assets are the property that is used as a means of labor in the production of goods, provision of services, or performance of work for more than a year.

Please note that from the beginning of 2016, the minimum cost of the OS began to be one hundred thousand rubles. In accounting, this amount is forty thousand rubles.

In this article we will look at all options for the receipt of fixed assets and equipment in 1C 8.3 Accounting.

The purchase of fixed assets can be registered in the 1C Accounting 3.0 program with the document “Receipts (acts, invoices)”, selecting the appropriate type (“equipment” or “fixed assets”).

For convenience, this document is also located in the “Fixed assets and intangible assets” menu in the form of two items with already established types: “Receipt of fixed assets” and “Receipt of equipment”.

A document with the type “Fixed Assets” is needed to account for those assets that do not require installation and additional costs.

- In the latest editions of 1C Accounting 8.3 (starting from 3.0.45), when using this type of operation, you do not need to additionally create a “” document. All postings are made as receipts with the type of operation “Fixed Assets”, which greatly simplifies the life of accountants.

- The type of operation “Equipment” implies a purchase on accounts: 08.04.1 and 07. Equipment received on account 07 requires further installation. The equipment that arrived to the account on 08.04 does not require installation, and in the future should be accepted for accounting. VAT is reflected on the account on 19.01.

In our example, we will consider the receipt of fixed assets, since this functionality is new. To do this, in the “Fixed assets and intangible assets” menu, select the “Receipt of fixed assets” item. In the list form that opens, create a new document.

As you can see, it combines the details of receipt and acceptance for accounting.

Fill out the counterparty and the agreement in the header of the document. The method for reflecting expenses will be filled in automatically, but you can adjust it if desired. You can also indicate the location of the OS and the financially responsible person, but these fields are not mandatory. In the event that this object will be rented out, it is necessary to set the appropriate flag.

It is very convenient to create a new fixed asset directly from the tabular part of this document. For the created object, the OS accounting group will be set in accordance with the value specified in the header. The depreciation group is filled in when recording a document with a value corresponding to the specified service life.

Postings for capitalization of OS in 1C

Post the document. All his movements will be displayed in the postings. In our case there will be three wirings:

- Dt 04/08/02 - receipt of fixed assets

- Dt 01.01 – acceptance of fixed assets for accounting

- Dt 19.01 – VAT

VAT upon receipt of fixed assets

In this example, VAT was posted, since the document parameters indicate that it is not included in the price. To change this setting, follow the corresponding hyperlink in the document header and check the “Include VAT in price” flag. Then, when posting the document, there will be no movement on the account 19.01.

In the purchase book, VAT will be reflected only after this document has been received.

If the receipt was reflected in a document with the transaction type “Receipt of equipment”, then it is additionally necessary to accept the fixed asset for accounting. This document is located in the menu “Fixed assets and intangible assets”, item “Acceptance for accounting of fixed assets”. We will not consider filling out this document, since we filled out all the necessary data, both for receipt and for acceptance for accounting, using the “Receipt of fixed assets” transaction type.

Invoice registration

Let's register an invoice for this document. To do this, enter its number, date at the bottom and click on the “Register” button.

Also watch a video on how to formalize the commissioning of an OS in two steps - first receipt, and then acceptance for accounting:

Thus, at the moment, an asset worth in the range from 40,000 rubles to 100,000 rubles in accounting should be taken into account as a fixed asset, and for profit tax purposes it should be classified as material expenses. In this article we will look at how in the 1C: Accounting 8 edition 3.0 program you can reflect the receipt and acceptance for accounting of such a fixed asset item. Let's consider an example. The organization "Rassvet" applies the general taxation regime - the accrual method and Accounting Regulations (PBU) 18/02 "Accounting for calculations of corporate income tax." The organization is a VAT payer. In January 2016, for management needs, the organization acquired a fixed asset worth 60,000 rubles plus 18% VAT (10,200 rubles). In the same month, the facility was registered and put into operation.

Accounting for fixed assets worth less than 40,000 in 1s 8.3

The useful life of this fixed asset is 30 months. The process of accounting for such an item of fixed assets in the program depends on how the organization intends to recognize material expenses for profit tax purposes. In accordance with paragraphs. 3 p. 1 art. 254 of the Tax Code of the Russian Federation, material expenses include the taxpayer’s costs for the acquisition of tools, fixtures, equipment, ..., and other property that is not depreciable property.

The cost of such property is included in material costs in full as it is put into operation.

How to capitalize wasps worth less than 40,000

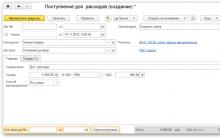

In order to write off the value of the property specified in this subparagraph for more than one reporting period, the taxpayer has the right to independently determine the procedure for recognizing material expenses in the form of the cost of such property, taking into account the period of its use or other economically feasible indicators. In other words, an organization can recognize material expenses at a time or recognize them gradually (monthly) over the useful life. First, we will consider the option with a one-time recognition of material expenses. In any case, the receipt of an item of fixed assets is documented using the document Receipt with the type of operation Equipment (in the section Fixed assets and intangible assets on the navigation panel, the item is called Receipt of equipment). The “header” of the document indicates the supplier counterparty and agreement with him.

How to capitalize fixed assets in 1s 8.3 accounting

In the same month, the fixed asset item was accepted for accounting and put into operation. To reflect this operation in the program, the document Acceptance for accounting of fixed assets with the type of operation Equipment is used. In the “header” of the document we indicate the location of the fixed asset, the financially responsible person and the event Acceptance for accounting with commissioning. On the Non-current asset tab, we indicate the type of operation we need, the method of receipt, and select our fixed asset object from the Nomenclature directory. Accounting account 08.04 is installed automatically. In the tabular section, on the Fixed Assets tab, create a Fixed Asset in the directory and fill in its details (in the Fixed Assets directory, only two tabs are manually filled in: Main and Additional). Let's fill in the Accounting tab.

Consultations: corporate property tax

Thus, for profit tax purposes, we recognized material expenses at a time. Along with the cost, temporary differences were also written off to account 26. The document Request-invoice and the result of its execution are shown in Fig. 5. Figure 5. We recognized 60,000 rubles of material expenses for tax purposes.

In accounting, expenses will be recognized only in subsequent periods in the form of depreciation amounts. We recognized temporary differences in the debit of account 01.01. When expenses in tax accounting are recognized in the current period, and in accounting will be recognized in subsequent periods, such temporary differences, in accordance with PBU 18/02, are called taxable temporary differences (TDT).

An example of filling out the corresponding document Acceptance for accounting of fixed assets and the result of its implementation are shown in Fig. 4. Figure 4. As we have already noted, for profit tax purposes, in accordance with paragraphs. 3 clause 1 article 254 of the Tax Code of the Russian Federation, the cost of such property is included in material costs in full as it is put into operation. Therefore, since we have placed the property, plant and equipment into operation, we can recognize material expenses.

For this purpose, we can use the document Requirement-invoice. On the Materials tab, you need to select the item transferred into operation and manually specify the account for its accounting on September 10. On the Cost Account tab, select account 26 “General business expenses”, and as an account analytics, indicate the cost item with the type expense Material expenses. When posting a document in tax accounting, the value of the property will be written off as a debit to account 26.

Accounting account 01.01 “Fixed assets in the organization”, the accounting procedure for depreciation and depreciation account 02.01 “Depreciation of fixed assets accounted for in account 01” are completely satisfactory to us. Depreciation is calculated using the straight-line method and is classified as general business expenses (account 26). The useful life is 30 months. On the Tax Accounting tab, you just need to indicate that the cost is not included in expenses, since there is no depreciable property for tax purposes.

When posted, the document will write off in accounting from the credit of account 08.04 to the debit of account 01.01 the generated initial cost of the fixed asset. Thus, we accepted for accounting and put into operation a fixed asset object with an initial cost of 60,000 rubles.

The received fixed asset (car, building, machine, etc.) must be taken into account in order for the VAT on its acquisition to be reflected in the purchase book, and.

The document “Receipts (acts, invoices)” generates postings 08.04 – 60.01, which means its receipt at the warehouse. In order to correctly accept OS for accounting in 1C 8.3 Accounting, a second posting is required from account 08.04 to 01.01. It is precisely this that is formed when it is accepted for accounting.

It is important to remember that in 1C 8.3 Accounting 3.0, starting from 2017-2018 (version 3.0.45), the developers significantly simplified this procedure by introducing a new type of operation “Fixed assets” for the document “Receipts (acts, invoices)”.

When registering a receipt in this way, the document generates both transactions, that is, there is no need to additionally accept the fixed asset for accounting. The fixed asset will immediately be listed in the account on 01.01. You can read more about this type of operation in the article “”.

In this example, we will consider the situation when you issued a receipt with the type of operation “Equipment”. In this case, you have only one posting - for account 08.04. We need to place the OS on account 01.01.

In the “Fixed assets and intangible assets” menu, select “Acceptance for accounting of fixed assets”.

In the document list form that opens, click on the “Create” button.

In the header, indicate the financially responsible person and the location of the OS, but these fields are not mandatory.

On the first tab of the document, fill in the method of receipt and department. In the equipment field, select the item item for which the receipt was previously created. The account will be filled in automatically, but you can change it.

Fixed assets

Next, go to the “Fixed Assets” tab. Add all required operating systems to the table. The default inventory number will be substituted from the directory details of the selected OS. It can be changed and then when you post a document, it will also change in the directory.

It is important to know! If you need to add several identical fixed assets (for example, 5 fixed assets), then in the fixed assets directory you should have 5 such elements with different inventory numbers.

Accounting and depreciation parameters

Go to the Accounting tab. By default, during commissioning in 1C 8.3, the account 01.01 was entered. We will not change this value. In the “Accounting procedure” attribute, set the value to “Depreciation calculation” and setting the parameters for depreciation calculation will become available.

By default, the linear method of accounting for depreciation will be used. This method is the most common. When using it, the cost of the accounting object is reduced in equal parts over the service life.

Fill in the depreciation account, useful life and other fields. There shouldn't be any problems with them.

Tax accounting

Go to the “Tax Accounting” tab. Indicate the original price of the OS according to NU, the date of purchase and the number of months of useful use.

Our organization is on the simplified tax system, so it is important to correctly indicate the procedure for including costs in expenses. It shows whether the asset is being depreciated and how such expenses are accounted for.

Below you must provide information about payments for all expenses before the object was accepted for accounting. All further payments must be made using the document “Registration of payment for fixed assets and intangible assets.”

With other tax systems, you do not need to indicate the payment. You will have to indicate the depreciation bonus - a percentage of the cost of the asset that can be written off for its construction or purchase.

Watch also the video on how to buy an OS and register it:

Tell your wish at home

Training “Creative Typography”

Fortune telling about pregnancy and the gender of the child

How to make a wish for the New Year so that it comes true

Strawberry jam, jam, marmalade