Concept estimates of the time value of money plays a fundamental role in the practice of financial computing. It predetermines the need to take into account the time factor in the process of carrying out any long-term financial transactions by assessing and comparing the cost of money at the beginning of financing with the cost of money when it is returned in the form of future profits.

In the process of comparing the value of money when investing and returning it, it is customary to use two basic concepts - the future value of money and its present value.

The future value of money (S) is the amount of funds currently invested into which they will turn after a certain period of time, taking into account a certain interest rate. Determining the future value of money is associated with the process of increasing this value.

The present value of money (P) is the sum of future cash receipts, given taking into account a certain interest rate (the so-called “discount rate”) for the present period. Determining the present value of money is associated with the process of discounting this value.

There are two ways to determine and calculate interest:

1. Decursive method of calculating interest. Interest is calculated at the end of each accrual interval. Their value is determined based on the amount of capital provided. The decursive interest rate (loan interest) is the ratio, expressed as a percentage, of the amount of income accrued for a certain interval to the amount available at the beginning of this interval (P). In world practice, the decursive method of calculating interest is most widespread.

2. Antisipative method(preliminary) interest calculation. Interest is calculated at the beginning of each accrual interval. The amount of interest money is determined based on the accrued amount. The anticipatory rate (discount rate) is the ratio, expressed as a percentage, of the amount of income paid for a certain interval to the amount of the accrued amount received after this interval (S). In countries with developed market economies, the anticipatory method of calculating interest was used, as a rule, during periods of high inflation.

66. Financial planning in an enterprise. To manage means to foresee, i.e. predict, plan. Therefore, the most important element of entrepreneurial economic activity and enterprise management is planning, including financial planning.

Financial planning is the planning of all income and areas of spending of an enterprise's funds to ensure its development. Financial planning is carried out through the preparation of financial plans of different contents and purposes, depending on the objectives and objects of planning. Financial planning is an important element of the corporate planning process. Every manager, regardless of his functional interests, must be familiar with the mechanics and meaning of the implementation and control of financial plans, at least as far as his activities are concerned. Main tasks of financial planning:

Providing the normal reproductive process with the necessary sources of financing. At the same time, targeted sources of financing, their formation and use are of great importance;

Respect for the interests of shareholders and other investors. A business plan containing such a justification for an investment project is the main document for investors that stimulates capital investment;

Guarantee of fulfillment of the enterprise’s obligations to the budget and extra-budgetary funds, banks and other creditors. The optimal capital structure for a given enterprise brings maximum profit and maximizes payments to the budget under given parameters;

Identification of reserves and mobilization of resources in order to effectively use profits and other income, including non-operating ones;

Ruble control over the financial condition, solvency and creditworthiness of the enterprise.

The purpose of financial planning is to link income with necessary expenses. If income exceeds expenses, the excess amount is sent to the reserve fund. When expenses exceed income, the amount of the lack of financial resources is replenished by issuing securities, obtaining loans, receiving charitable contributions, etc.

Planning methods are specific methods and techniques for calculating indicators. When planning financial indicators, the following methods can be used: normative, calculation and analytical, balance sheet, method of optimizing planning decisions, economic and mathematical modeling.

The essence of the normative method of planning financial indicators is that, on the basis of pre-established norms and technical and economic standards, the need of an economic entity for financial resources and their sources is calculated. Such standards are tax rates, rates of tariff contributions and fees, depreciation rates, standards for the need for working capital, etc.

The essence of the calculation and analytical method of planning financial indicators is that, based on an analysis of the achieved value of the financial indicator taken as the base, and the indices of its change in the planning period, the planned value of this indicator is calculated. This planning method is widely used in cases where there are no technical and economic standards, and the relationship between indicators can be established indirectly, based on an analysis of their dynamics and connections. This method is based on expert assessment

The essence of the balance sheet method of planning financial indicators is that by constructing balance sheets, a link is achieved between the available financial resources and the actual need for them. The balance sheet method is used primarily when planning the distribution of profits and other financial resources, planning the need for funds to flow into financial funds - an accumulation fund, a consumption fund, etc.

The essence of the method for optimizing planning decisions is to develop several options for planning calculations in order to select the most optimal one.

The essence of economic and mathematical modeling in planning financial indicators is that it allows you to find a quantitative expression of the relationships between financial indicators and the factors that determine them. This connection is expressed through an economic-mathematical model. An economic-mathematical model is an accurate mathematical description of the economic process, i.e. description of factors characterizing the structure and patterns of change in a given economic phenomenon using mathematical symbols and techniques (equations, inequalities, tables, graphs, etc.). Financial planning can be classified into long-term (strategic), current (annual) and operational. The strategic planning process is a tool that helps in making management decisions. Its task is to ensure innovation and change in the organization to a sufficient extent. There are four main types of management activities within the strategic planning process: resource allocation; adaptation to the external environment; internal coordination; organizational strategic foresight. The system of current planning of the company's financial activities is based on the developed financial strategy and financial policy for individual aspects of financial activities. Each type of investment is linked to a source of financing. To do this, they usually use estimates of the formation and expenditure of funds. These documents are necessary to monitor the progress of financing the most important activities, to select optimal sources of replenishment of funds and the structure of investment of own resources.

The current financial plans of an entrepreneurial company are developed on the basis of data that characterizes: the financial strategy of the company; results of financial analysis for the previous period; planned volumes of production and sales of products, as well as other economic indicators of the company’s operating activities; a system of norms and standards for the costs of individual resources developed by the company; the current tax system; the current system of depreciation rates; average lending and deposit interest rates on the financial market, etc. Operational financial planning involves creating and using a cash flow plan and statement. The payment calendar is compiled on the basis of the real information base of the enterprise's cash flows. In addition, the enterprise must draw up a cash plan - a cash turnover plan that reflects the receipt and payment of cash through the cash register.

Today it is not enough to calculate simple or complex interest; not a single bank uses them in their pure form. It is more profitable for banks to use not only different types of interest calculations, but also different calculation concepts, which in turn strongly depend on the terms of the contracts. Let's consider the main method (concept) of calculating interest rates, this is the method of decursive calculation of interest.

Today, this is the most common method of calculating interest, which is used in world practice. The basis of this concept is “from present to future”, where at the end of a specified time interval interest is accrued or accrued interest is paid on the base deposit. For decursive interest calculation, both a simple interest calculation and an accrual rate are used, in other words, a complex interest calculation is used. Below is a graphical display of the income on the deposit depending on the chosen method of interest calculation and its term.

In the case of low interest rates, the decursive method is more beneficial to the borrower than to the lender. And this method is best used for short-term financial transactions. Moreover, it is advisable to invest for a period of no more than a year, with interest payments at the end of each time interval. Ideally, the decursive method is used when it coincides with the interest calculation interval. However, this does not mean that decursive interest cannot be used in any other cases. It all depends on the agreement of the parties involved in the financial transaction.

Stay up to date with all the important events of United Traders - subscribe to our

There are two fundamentally different ways of calculating interest: decursive and anticipatory.

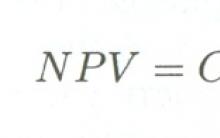

At decursive way interest is accrued at the end of each accrual interval based on the amount of capital provided at the beginning of the time interval. Decursive interest rate ( i) is called loan interest and is determined by the formula:

i = I / PV,

Where I PV– the amount of money at the beginning of the time interval.

At in an antiseptic way interest accrual, they are accrued at the beginning of each accrual interval, based on the accumulated amount of money at the end of the interval (including capital and interest). Anticipatory interest rate ( d) is called discount rate and is determined by the formula:

d=I/FV,

Where I– interest income for a certain time interval; F.V.– the accumulated amount of money at the end of the time interval.

In practice, the decursive method of calculating interest is most widely used. The anticipatory method is used in accounting transactions for bills of exchange and other monetary obligations. The amount of money at the end of the accrual interval is considered the amount of the loan received. Since interest is accrued at the beginning of the time interval, the borrower receives the loan amount minus interest. This operation is called discounting at discount rate or bank accounting. Discount- this is the difference between the size of the loan and the amount directly issued, that is, the income received by the bank at the discount rate.

Both decursive and anticipatory methods can use schemes for calculating simple and compound interest. When using a simple interest scheme, they are calculated on the amount of the initial deposit. Compound interest involves the capitalization of interest, that is, the calculation of “interest on interest.”

From the point of view of the creditor, when carrying out financial transactions of a short-term nature (less than a year), the simple interest scheme is more profitable, and for long-term transactions (more than a year), the compound interest scheme is more profitable. For long-term transactions with a fractional number of years, the so-called mixed scheme is beneficial, when compound interest is accrued for a whole number of years, and simple interest is accrued for the fractional part of the year.

In table formulas for determining the accumulated amount of money, that is, the future value of the deposit, are systematized using decursive and anticipatory methods of calculating interest. The following notations are used:

F.V.– future (accumulated) amount of money;

PV– real (current) amount of money;

i– loan interest rate;

d- discount rate;

n– number of years in the interest calculation interval;

m– number of intra-annual interest accruals;

t– duration of the interest accrual interval for short-term transactions, days;

T– length of the year, days;

w– integer number of years in the accrual interval;

f– fractional part of the year in the accrual interval.

Table

Formulas for calculating the accumulated amount of money under various conditions for calculating interest

| Conditions for calculating interest | Interest calculation method | |

| Decursive | Antisipative | |

| simple interest, an integer number of years in the accrual interval | FV = PV´ (1 + in) | FV = PV / (1 – dn) |

| compound interest, integer number of years in the accrual interval | FV = PV´ (1 + i)n | FV = PV / (1 – d) n |

| simple interest, transaction period less than a year | |

|

| mixed interest calculation scheme with a fractional number of years in the accrual interval | FV = PV´ (1 + i) w (1 + if) | FV = PV / [(1 – d) w (1 + if)] |

| compound interest, intra-annual accruals with an integer number of years in the interest accrual interval | FV = PV´(1 +i/m) nm | FV = PV / (1 –d/m) nm |

Antisipative method

Anticipatory interest rate (discount rate or anticipatory interest) is the ratio of the amount of income accrued for a certain interval to the accrued amount received at the end of this period. With the anticipatory method, the accumulated amount received at the end of the period is considered the amount of the received credit (loan), which the borrower is obliged to repay. He receives an amount less than the lender's interest income. Thus, interest income (discount) is accrued immediately, i.e. remains with the lender. This operation is called discounting at a discount rate, commercial (banking) accounting.

Discount- income received at the discount rate, as the difference between the amount of the repaid loan and the amount issued: D = F - R.

Simple discount rates

If you enter the notation:

d, % - annual discount rate;

d- relative value of the annual discount rate;

D- the amount of interest money (discount) paid for the period (year);

D- the total amount of interest money (discount) for the entire accrual period;

R - the amount of money issued;

F- amount returned (loan amount);

k n - growth factor;

P - number of accrual periods (years);

d- duration of the accrual period in days;

TO - length of year in days K = 365 (366), then the anticipatory interest rate can be expressed as

Then at

Then (6.20)

Example. The loan is issued for 2 years at a simple discount rate of 10%. The amount received by the borrower P = 4 5,000 rub. Determine the amount returned and the discount amount.

![]()

Discount: rub.

Hence the inverse problem.

Example. The loan is issued for 2 years at a simple discount rate of 10%. Calculate the amount received by the borrower and the discount amount if you need to return 50,000 rubles.

Discount: rub.

If the accrual period is less than a year, then

From here, ![]()

Example. The loan is issued for 182 days of an ordinary year at a simple discount rate of 10%. The amount received by the borrower R = 45,000 rub. Determine the amount returned.

Complex discount rates

If the loan is repaid after several accrual periods, then income can be calculated using the method of complex discount rates.

If you enter the notation:

d c , % - annual discount rate;

d c - relative value of the annual discount interest rate;

f - the nominal discount rate of compound interest used when calculating the discount at intervals, then when calculating the accrued amount but at the end of the first period, the accrued amount

At the end of the second period ![]()

Through P years, the accumulated amount will be . (6.23)

Then the increase coefficient is . (6.24)

Example. The loan is issued for 3 years at a compound discount rate of 10%. The amount received by the borrower P = 43,000 rub. Determine the amount returned and the discount amount.

![]()

P is not an integer, then the increase coefficient can be represented as follows:

(6.25)

(6.25)

Where p = p c + d/K - the total number of accrual periods (legs), consisting of integer and non-integer accrual periods; p c D- number of days of non-integer (incomplete) accrual period; K = 365 (366) - number of days in a year; d c - relative value of the annual discount interest rate.

Example. The loan is issued for 3 years 25 days at a complex discount rate of 10%. The amount received by the borrower P = 45,000 rub. Determine the refundable amount and the discount amount.

Discount amount D = F - P = 62,151 - 45,000 = 17,151 rubles.

If the discount rate during periods nv ..., n N different d 1 d 2 , ..., d N , then the formula for the accrued amount takes the form

Example. The loan is issued at a complex discount rate of 10.9.5.9%. The amount received by the borrower, P = 45,000 rubles. Determine the amount returned.

When interest is calculated at intervals during the period m times the formula of the accrued amount

Example. The amount received by the borrower is 10,000 rubles. issued for 3 years, interest is accrued at the end of each quarter at a nominal rate of 8% per annum. Determine the amount to be refunded.

If the number of compounding periods N is not an integer, then the increase coefficient can be represented as

(6.28)

(6.28)

Where p c - the number of whole (full) periods (years) of accrual; T - number of accrual intervals in the period; R - the number of whole (full) accrual intervals, but less than the total number of intervals in the period, i.e. R<т; d - the number of days of accrual, but less than the number of days in the accrual interval.

Example. The loan is issued for 3 years 208 days (183 + 25 days) at a complex discount rate of 10%. Payment by half-year (T = 2). The amount received by the borrower R = 45,000 rub. Determine the amount returned and the discount amount.

In addition, you can define other parameters:

![]() (6.30)

(6.30)

Inverse problem:

Example. The loan is issued for 3 years at a compound discount rate of 10%. The amount to be returned is F= 45,000. Determine the amount received by the borrower.

The price of money is the fee for the temporary use of “other people’s” money; it is determined in the form of simple or compound interest. Interest - this is income from the provision of capital in debt, that is, a monetary fee charged for the use of money. If interest has a value, it is usually called interest money. By lending money today, the owner exposes himself to the risk of not returning it, that is, not receiving income from possible investments, and reduces his liquidity. Therefore, he seeks to compensate for losses - to receive income from lending money. This income is called interest money.

Interest rate– a value characterizing the intensity of interest accrual.

Interest period– the period of time for which interest is calculated (the period for which the money is provided).

Accrual interval– the minimum period after which interest accrues.

There are two ways of calculating interest: decursive and anticipatory.

Decursive method of calculating interest– increase in the initial amount by interest rate. Interest (more correctly, interest money) is paid at the end each accrual interval.

Decursive interest rate (i), called loan interest,- this is the ratio of the amount of income accrued for a certain interval, expressed as a percentage I(interest money) to the amount available at the beginning of this interval – P.

Increase (growth) of the initial amount of debt– increasing the amount of debt by adding accrued interest.

S = P + I, (4.1)

I = S – P, (4.2)

Where S– accumulated amount.

Increment factor K n is defined as follows:

Interest rate i is a relative value, measured in fractions of a unit and determined by dividing the interest money by the original amount.

. (4.4)

. (4.4)

The formula for calculating the interest rate is identical to calculating the statistical indicator “growth rate”.

Determination of the accrued amount S called compounding . Determining the initial amount R – discounting.

The day of receipt and the day of final repayment of the loan are considered one day (cutoff day). Interest on loans and deposits is usually calculated daily. In this case, either the exact number of days in a year (360/365) or the bank number (30 days) can be used.

At antiseptic method of calculating interest (preliminary) interest is paid at the beginning of the period for which interest accrues. Example: interest charged by a bank when discounting bills of exchange; for factoring credit, etc. The amount of the loan received is the accrued amount S. Based on it, interest is calculated. The borrower receives the loan amount minus interest.

Difference between loan size S and the amount issued R called discount, denoted by D and represents the amount of interest money.

D = S – P. (4.5)

Discount rate, expressed in fractions of a unit and determined by dividing the discount amount by the amount R, called discount rate d .

. (4.6)

. (4.6)

It can be noted that the amount of interest I and the discount amount D are defined in the same way. However, in the first case we are talking about an increase in the current value, a kind of “markup”, that is, the future value of “today’s money” is determined. In the second case, the present value of future money is determined, that is, a “discount” is determined from the future value (diskont in German means “discount”).

Most often, the anticipatory method is used for purely technical purposes - when discounting, as well as when accounting for bills of exchange in a bank and when paying for factoring services. In all other cases, the decursive method of calculating interest is more common in world practice.

The anticipatory method is used in countries with developed market economies during periods of high inflation, since the increase in the anticipatory method occurs at a faster pace than with the decursive method of accrual.

In the economic practice of the Republic of Belarus, the decursive method of calculating simple interest is currently used mainly. Interest on accounts is accrued in accordance with the agreement between the bank and the client. On accounts for credit and deposit transactions, interest is accrued for the period including the day the loan is issued or money is credited to the deposit, and the day preceding the repayment of the loan or issuance of the deposit (closing the account). If the interest rate changes, interest is accrued at the new rate from the date it was established.

Control of the elements of water, fire, air and earth

Russians are God's third chosen people. Why are Jews considered the chosen people?

Honey mushroom soups: recipes for first courses Canned honey mushroom soup recipe

What you need to know about the Holy Fire How the Holy Fire appears

Fortune telling by flowers. Color fortune telling. Fortune telling on petals